If you’d read some of my past posts, it’s no mystery that I’m a proponent of long-term investing. I believe the adage “Good things come to those who wait” is true for the stock market too. If you look at historical market performance, you’ll see several peaks and valleys, but the overall trend is growth. That means, if you simply make smart investments (consulting your financial advisor is a good idea!) and leave them, you should see a nice return in a few decades.

I know, I know—waiting a few decades is not appealing to a lot of people. Some get the idea that they can time the market and make gobs of money in one fell swoop. Sure, that’s possible, and a handful of people have successfully done it. But is it likely? Not really.

Novice investors tend to have poor timing, and even if they time the market just right on occasion, doing it over and over again is nearly impossible (especially when you’re up against the sophisticated algorithms used by full-time traders). Brian Bloch of Investopedia confirms that “It is nearly impossible to time the market successfully compared to staying fully invested over the same period” and this has been confirmed by many different studies reported in the Financial Analyst Journal, Journal of Financial Research, and more.

If you’re still not convinced that patience and a long-term approach are the smartest ways to invest, consider this: Most of the money gained in the stock market has been made during only a handful of days.

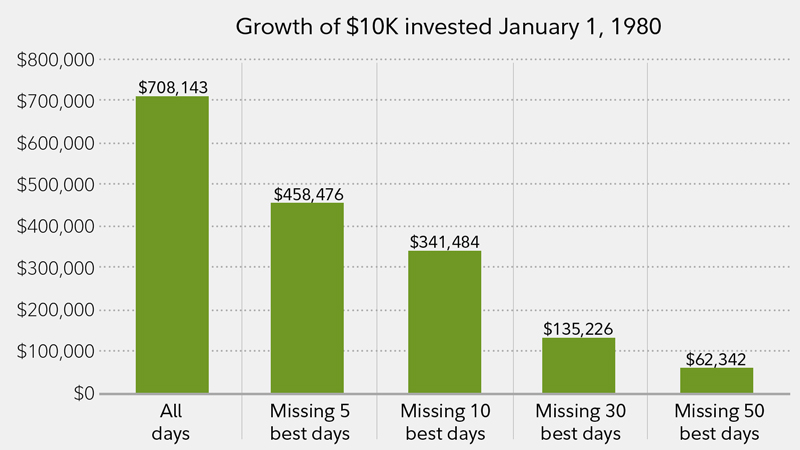

What does that mean? It means that the market occasionally experiences large upward swings, and if your money isn’t sitting in an investment account, you’ll miss out on enormous gains. Fidelity studied these upward swings in the S&P 500 index fund between 1980 and 2018, and found that missing only the FIVE best days of investing drops your overall return by 35%!

Take a look at the chart below:

As you can see, $10,000 invested on January 1, 1980 had the potential to grow to over $700K in the S&P 500 index. However, if you tried to time the market and missed a few of the market’s best days, that amount would be cut significantly.

Though it’s not an exciting approach, it simply makes sense to approach investing as you would farming: Plant your seeds in the right places, water your plants, and don’t harvest them until the season’s end. In other words, work with an advisor to make smart investments, and then sit tight through the valleys and peaks. Abundant evidence shows that this is the wisest approach.