If you’ve been listening to the news lately, you’ve been hearing all kinds of doom and gloom predictions about the national and global economy. The global economy is slowing, we’re in the middle of trade war with China, and the stock market has been especially volatile lately. Not to mention, there’s a lot of talk about the yield curve for U.S. Treasury bonds inverting, which (without getting too deep into it) has been a past indication that a recession is on the horizon.

With all these signs of future trouble, how could anyone possibly be feeling optimistic right now? Well, I’ll give you a few reasons…

1. Unemployment remains low

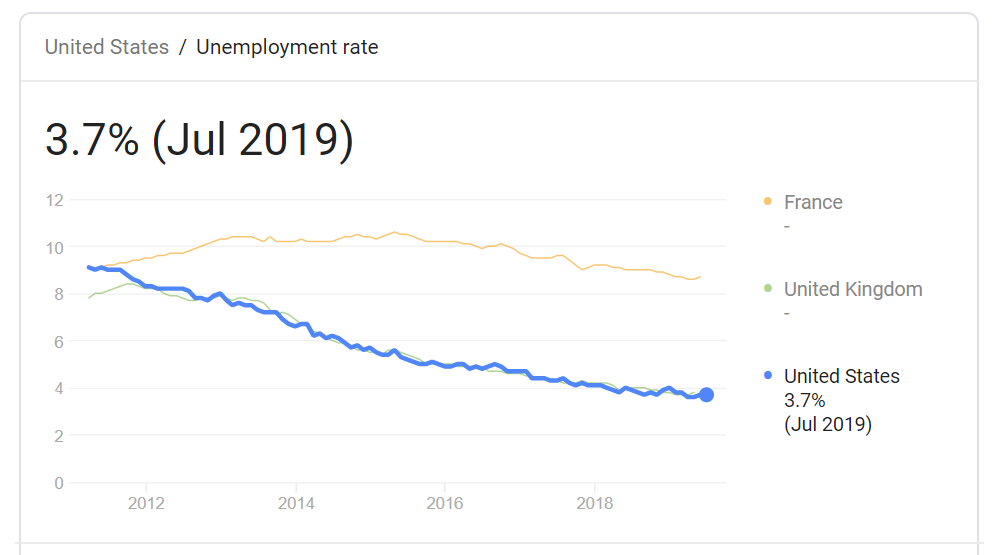

The U.S. has been on an excellent streak when it comes to unemployment. The rate in July was only 3.7%, and there’s no sign that it will rise anytime soon. When people are employed, they spend money and keep the economy chugging along. This, alone, is reason to hope that any recession we might enter into won’t be too terrible.

As you can see on the chart below, the unemployment rate has been steadily decreasing since 2012:

2. Consumer confidence is high

Despite a recent dip in consumer confidence (perhaps due to an abundance of negative news!), consumer confidence remains quite high. In fact, according to Bloomberg, it’s the highest it’s been in 19 years. That means people are still feeling comfortable spending money, and are not anticipating any dramatic changes to their income or spending power any time soon. When so much of the economy relies on the whims of the public, this is good news, indeed.

3. The stock market is still strong

Even though the market is experiencing some ups and downs right now, overall it has been consistently strong over the past several years. Might that change? Possibly, but as I’ve said time and again, investing in the stock market is a long term strategy. It doesn’t pay to get nervous at the first sign of trouble and pull out all your money. Part of investing in stocks is knowing that the market will inevitably take some downturns. When that happens, it’s best to ride the storm and possibly talk to your financial advisor about additional alternative investment strategies you can pursue while waiting for the market to correct itself again.

4. U.S. innovations and technologies are still prized

Though there are signs that the U.S. manufacturing sector is slowing down, there are plenty of other industries that are experiencing sustained growth. In particular, the U.S. still stands out as a chief innovator in science and technology. Jobs in this industry are high-paying and vital on both a national and global scale. Though this area of the economy isn’t completely recession-proof, it’s robust enough to withstand any economic woes we may experience in the future.

Take heart! There are still plenty of reasons to believe that the U.S. economy is strong. Even if we do experience a temporary recession, there are plenty of hopeful signs that we’ll chug along just fine.